bexar county tax office pay online

Other locations may be available. For convenience Taxpayers can now request to receive their Property Tax Statement via email.

Our office is responsible for over 14 million vehicle registrations per year and for collecting over 25 billion in taxes in a fair and equitable manner.

. You can search for any account whose property taxes are collected by the Bexar County Tax Office. For questions regarding tax amounts visit the County Tax Office Website email or call 210 335-2251. The Bexar County Tax Office offers the option of paying your Property Taxes online with either.

10 in favor of a proposal to raise the countys property tax rate by 8. San Antonio TX 78207. This service includes filing an exemption on your residential homestead property submitting a Notice of Protest and receiving important notices and other information online.

The Bexar County Tax Office offers the option of paying your Property Taxes online with either a major credit card or an electronic check ACH. Tax Bills Who to Contact for Tax Bills. May 5 2022 20553 AM.

Please select the type of payment you are interested in making from the options below. Thank you for visiting the Bexar County ePayment Network. Pay your property taxes online.

Our office is committed to providing the best customer service possible for all our citizens. After logging in to your portfolio you can add more. Ad Bill Pay Has Never Been Easier.

Each portfolio may consist of one or more properties and includes pertinent tax information such as property location certified owner and current year and total amounts due. Justice of the Peace Online Payments. County tax assessor-collector offices provide most vehicle title and registration services including.

Bexar County Tax Assessor-Collector Albert Uresti Bexar County TX - Official Website. Bexar Central Appraisal District. 411 North Frio Street San Antonio TX 78207 Mailing Address.

In case you missed it the link opens in a new tab of your browser. Monday - Friday 8AM - 5 PM. The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically.

In addition to billing and collecting City of San Antonio Property Taxes the Bexar County Tax Collectors Office is also providing property taxes collection services. The tax increase would have raised the bill for an owner of. After locating the account you can pay online by credit card or eCheck.

Please contact your county tax office or visit their Web site to find the office closest to you. 411 North Frio Street. Search accounts whose taxes are collected by Bexar County for overpayments.

Resources and request portals for Bexar County Information. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. Acceptable forms of payment vary by county.

You can send us your protest by mail at. Attorney Unavailable Dates Form. Property Tax Payments Online.

Pay Your County of Bexar Bill Online with doxo. Property Tax Payments Online. You can create a portfolio if you want to group multiple tax accounts together for easier review and payment.

Bexar County Tax Office. Offered by County of. Property Tax Payments Online.

San Antonio TX 78283. After locating the account you can also register to receive certified statements by e-mail. You may stop by our office and drop your protest in our dropbox located in the front of the building.

Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details. Child Support Online Payments. Your property tax burden is decided by your locally elected officials and all inquiries concerning your local taxes should be directed to those officials Property Search Data last updated on.

Tax Rate In Houston HOUSTON CN Two Texas Republicans prevented their Democratic. Clicking on the link below will take you to to a webpage with specific information and instructions for making that type of payment through our convenient and secure online. Box 839950 San Antonio TX 78283-3950 Telephone.

Albert Uresti MPA Physical Address. 233 N Pecos La Trinidad San Antonio TX 78207 Mailing Address. The Online Portal is also available to agents that have been authorized to.

As part of this interlocal agreement the City of San Antonio also manages bill collection and collection of its taxThe intersection of Pleasanton Rd and Southside is situated. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. Search for any account whose property taxes are.

Welcome to the Bexar County. The Easiest Way To Pay Your County of Bexar Bill Securely with doxo.

15 000 Homeowners In Bexar County Eligible For Help On Delinquent Property Taxes Kens5 Com

Chief Appraiser Expects A New Record Of Appeals To Be Filed Next Week In Bexar County

Real Property Land Records Bexar County Tx Official Website

Property Tax Information Bexar County Tx Official Website

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

Bexar County Tax Assessor Collector 30 Reviews Tax Services 233 N Pecos La Trinidad San Antonio Tx Phone Number Yelp

Bexar County Commissioners Approve Funding For Uh Public Health Division Homestead Property Exemption Tpr

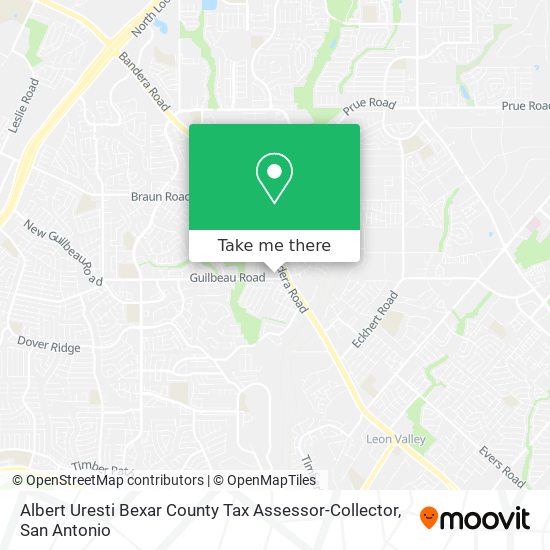

How To Get To Albert Uresti Bexar County Tax Assessor Collector In San Antonio By Bus

Bexar County Precinct 1 Justice Of The Peace Court In San Antonio

News Flash Bexar County Tx Civicengage

Everything You Need To Know About Bexar County Property Tax

Payments Bexar County Tx Official Website

Cash Strapped Property Owners In Bexar County Face June 30 Tax Deadline Tax Deadline Bexar County County

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Everything You Need To Know About Bexar County Property Tax

Bexar County Tax Assessor Collector 7663 Guilbeau Rd San Antonio Tx Department Of Motor Vehicles Mapquest